Valuation Caps and Conversion Discounts

Delve into the mechanics of how investors structure convertible debt arrangements with valuation caps and conversion discounts to protect the value of their investments.

When raising seed financing,1 many companies prefer to use convertible debt instead of preferred stock. Convertible debt provides many advantages to companies raising capital including a shorter timeline and fewer legal expenses (see our Convertible Debt and Preferred Stock article to learn more about convertible debt). In exchange for their investment, seed investors typically include special provisions called valuation caps and conversion discounts to further protect their investment. This article addresses the purpose and function of both valuation caps and conversion discounts, and how they can affect your ownership in your company.

Economics of Convertible Debt

Valuation caps and conversion discounts are mechanisms by which convertible debtholders can convert their debt positions into preferred equity at a lower company valuation than the latest funding round. From an investor’s perspective, higher valuations reflect more expensive investments since investors must pay more for the same level of ownership. By investing at a lower valuation, convertible debtholders receive equity ownership at a cheaper rate than the current valuation.

A review of some of the basic principles of startup financing and convertible debt illustrates why startup investors require a reduced conversion price. First, remember that the earlier an individual invests in a startup, the more risk they are exposed to. Uncertainty surrounding the viability of a startup’s business model usually decreases over time, making later investments less risky. Most convertible debt arrangements for startup companies occur during seed funding, the stage at which startups often raise their first significant amounts of funding. Meanwhile, VC investors typically only invest in startups at or after the Series A round2, avoiding much of the risk that seed investors experience.

Unlike preferred stock deals, convertible debt arrangements do not assign specific company valuations. Instead, convertible debtholders wait for investors in future financing events (often Series A funding rounds) to set a valuation. If the next financing round meets the definitions of a qualified financing event3, a convertible debt position automatically converts into preferred stock and retires the outstanding debt. Convertible debt investors usually receive preferred stock upon conversion, because it provides additional investor protections not available to common stockholders, like liquidation preferences and anti-dilution provisions. Most convertible debt arrangements specify that, upon conversion, the preferred stock granted to the convertible debt investors will have the same rights as the preferred stock issued during the qualified financing event. Thus, convertible debtholders receive the same rights as other investors without having to enter a time-intensive negotiation process. (For more information on these investor protections, read our Term Sheets Overview, Liquidation Preferences, and Anti-dilution Provisions articles.)

The number of shares of stock that investors receive upon conversion is determined by dividing their initial investment by the conversion price dictated in the convertible debt agreement. For example, if an angel investor owned $100k of convertible debt, the position would convert into 50k shares of stock at a $2 conversion price ($100k / $2 = 50k).

Since convertible debt agreements do not establish a valuation for the company (or its shares), the conversion price cannot be fixed at the time of the convertible debt investment. Instead, the conversion price must be set relative to a future qualified funding round that has a formal valuation. In the absence of a valuation cap or conversion discount, the conversion price is often set at the same price per share of the next qualified funding round. Using the same share price for both the convertible debt conversion and the most recent funding round denies the convertible debtholders any reward for the additional risk of investing earlier in the company. Valuation caps and conversion discounts aim to fix this problem by decreasing the price of equity for convertible debtholders, compensating them for the additional risk they assumed when making their original investment.

Valuation Caps

Valuation caps place a limit on the price at which convertible debt will become equity. The conversion to equity occurs at the lower of the valuation cap or the valuation set in the current funding round. If the startup’s valuation in the subsequent financing round exceeds the cap, the debt converts into equity as if the valuation were at the cap. If the startup’s valuation is lower than the cap, the debt is converted to equity at the current valuation. These concepts will be illustrated via examples later in this section. (See Scenarios 1 and 2.)

Valuation caps protect convertible debtholders from situations where startups experience large increases in value between the issuance of convertible debt and the subsequent funding round. If the company experiences tremendous growth in its valuation between seed financing and the Series A round, the convertible debtholders will only receive a very small percentage of the next round without a valuation cap. (See Scenario 1.)

Most investors will require some level of valuation cap, but you should be careful about accepting deals with low valuation caps. Lower caps can provide convertible shareholders with a larger ownership percentage upon conversion, diluting not only your personal stake but that of the investors providing the next round of funding. Potential investors may become wary of funding your startup due to concerns about having their stake diluted by convertible debtholders. (For more information on dilution, see our Dilution and Stock Pools article.)

Scenario 1: No Valuation Cap, No Conversion Discount

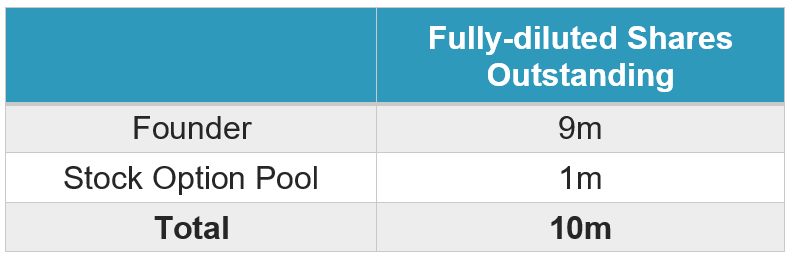

Consider a hypothetical startup which accepts $1 million (m) in convertible debt seed funding from an angel investor. A year and a half later, the company closes a $5m Series A round at a $10m pre-money4 valuation. The cap table5 below shows the ownership structure of the startup immediately prior to the Series A financing, including 1m shares reserved for an employee stock option pool. (Note that the convertible debt does not appear on the cap table initially because we do not know how many shares the convertible debt will convert to.)

The number of fully-diluted6 shares outstanding, the pre-money valuation, and the amount of the Series A investment provide enough information to calculate the number of shares that the Series A investor will receive. The Series A investor pays $1 for each share of stock, as calculated by dividing the pre-money valuation ($10m) by the total number of fully-diluted shares (10m).

Therefore, the Series A investor receives 5m shares of stock ($5m investment / $1 price).

One way to verify that the calculations are correct is to compare the price per share before and after the funding round. If calculated correctly, the share price should stay the same. For example, the pre-money valuation share price was $1.00. (Pre-money valuation / Fully Diluted Shares Outstanding = $10m / 10m = $1.00) The post-money share price is also $1.00, after accounting for the $5m investment and the issuance of 5m more shares.

After the Series A round is finalized, the convertible debt automatically converts to preferred stock with the Series A price per share serving as the conversion price ($1/share) because there is no valuation cap. The convertible debtholder receives 1 m shares in exchange for their convertible debt holdings ($1 m investment / $1 conversion price). The resulting ownership structure is presented in the cap table below.

As illustrated in the cap table, the angel investor only retains a small percentage of the company after the Series A financing round. Although the angel investor contributed substantially to the development of the startup, it has not captured much of its value. The angel investor must pay just as much for her shares of stock as the Series A investor, even though the angel took on much more risk by investing earlier in the company.

This scenario illustrates how convertible debtholders are not compensated for the risk that they assume without valuation caps or conversion discounts. As a result, few seed investors would agree to a convertible debt agreement lacking these features.

Scenario 2: $5m Pre-money Valuation Cap, No Conversion Discount

Now consider how the ending cap table from Scenario 1 would differ if the convertible debt investor had a pre-money valuation cap of $5m. Using the same facts as the first scenario, the amount of stock issued to all shareholders except for the angel investor would remain the same. The existence of a valuation cap could potentially change how many shares the angel investor receives upon conversion. The conversion ratio implied by the conversion cap is calculated by dividing the valuation cap by the number of fully-diluted shares, arriving at a value of $0.50 ($5m / 10m).

With the valuation cap, the angel investor can convert the $1m in convertible debt at the lower of either 1) the Series A price ($1.00) or 2) the valuation cap conversion price ($0.50). A lower price will yield additional shares of stock to the angel investor. Dividing the amount of convertible debt by the conversion price produces the number of shares that the angel investor will receive (2m = $1m / $0.50). The cap table below shows how the ownership structure would look with a valuation cap.

With the valuation cap, the angel investor’s stake in the company increased from 6.25% (Scenario 1) to 11.8% (Scenario 2). Although the Series A investor still receives more shares of stock in the company than the angel investor, this relates to the much larger size of the Series A investor’s investment. The angel investor buys her shares at half the rate of the Series A investor, reflecting the increased risk of the angel’s investment.

With the inclusion of a valuation cap, the Series A investor, the founder, and the employees that participate in the stock option pool all experience dilution. These decreases in ownership highlight the importance of setting the valuation cap at a fair and reasonable level. If the cap level is set too low, founders may experience a significant loss of value, investors may be wary of investing in the company, and employees may decide not to join the startup if their stock option programs are subject to too much dilution. Since convertible debt often doesn’t appear on the cap table until conversion, some founders may not realize that they must give away any equity to these debtholders at all.

It is also important to remember that just because a deal includes a valuation cap, the cap may not affect the number of shares issued in a transaction. If the valuation cap is higher than the pre-money valuation from the next funding round, the convertible debtholders will convert at the price per share of the funding round and the cap goes unused. For example, Scenario 2 would have had an identical ending cap table to Scenario 1 if the valuation cap had been set at any level at or above $10m, the Series A pre-money valuation.

Conversion Discounts

Conversion discounts represent a different way to lower the convertible debtholder’s conversion price. A conversion discount lowers the conversion price to a percentage of the subsequent funding round’s valuation. For example, a convertible note with a 20% discount allows convertible debtholders to convert to stock at 80%, or “20% off” the share price paid in the subsequent funding round as a reward for the increased risk of their investment. The conversion discount always provides the convertible debtholders with a lower conversion price than the investors who invested in the subsequent funding round, better reflecting the underlying economics of the investment.

Just as with valuation caps, you must be careful about setting a conversion discount too high. Most investors will insist on including some version of conversion discount in the arrangement, but their demand should be reasonable. Ownership in the firm is a zero-sum game7: providing more equity to seed investors results in less equity for yourself and future investors. Fenwick & West, a large law firm specializing in startup financing, found in a 2011 survey that most discounts used in seed financing range from 10-35%, and 20% was the median discount.

Scenario 3: No Valuation Cap, 20% Conversion Discount

Consider the same situation as Scenarios 1 and 2, but the convertible debt agreement includes a 20% conversion discount instead of a valuation cap. Rather than converting at $1 per share, as in Scenario 1, the angel investor can convert her shares at $0.80 per share ($1 x (1-20%)). The cap table below shows how the ownership structure would change.

The 20% conversion discount provides the convertible debtholder with a higher stake in the company than when the agreement did not have a conversion discount or valuation cap (Scenario 1). The inclusion of a conversion discount guarantees that the convertible debtholder will always receive stock at a cheaper rate than the latest investors, regardless of the valuation.

The 20% conversion discount resulted in a higher conversion price ($0.80 in Scenario 3) than the valuation cap ($0.50 from Scenario 2), but that simply reflects the facts presented in this example. Depending on the size of the pre-money valuation, the valuation cap, and the conversion price, sometimes the valuation cap will be more beneficial and other times the conversion discount is more beneficial. Since convertible debtholders and founders do not know future pre-money valuation levels beforehand, they often have difficulty determining which feature is preferable at the time of signing.

Scenario 4: $5m Pre-money Valuation Cap, 20% Conversion Discount

Since valuation caps and discounts offer complementary protections to investors, many convertible debt agreements include both features. In such scenarios, convertible debtholders can use whichever option provides the best deal. Convertible debtholders will determine the lowest valuation among: 1) the subsequent funding round’s price per share, 2) the valuation cap conversion price, and 3) the conversion discount price. To illustrate this decision, we will analyze elements from each of the past three scenarios.

In this scenario, company management would need to calculate the conversion price for the valuation cap and the conversion discount. (Since the conversion discount price will always be lower than the pre-money valuation, this price does not need to be analyzed.) The calculations from Scenarios 1-3 are presented below:

Since the valuation cap provides the cheapest conversion price (and the most equity to the convertible debtholder), the debt would convert at $0.50 per share. After the conversion, the cap table for this scenario would be the same as the table shown in Scenario 2.

The simple scenarios presented in this article help illustrate how valuation caps and conversions discounts can affect a convertible debtholder’s stake in a company. In practice, the final cap table amounts would need to be adjusted for the conversion of any accrued interest on the convertible bonds. Also, the conversion of convertible debt into preferred stock would create additional liquidation preferences, further complicating the cap table during a liquidation event. (For more information on this topic, see our Liquidation Preferences article.)

Conclusion

Understanding the implications of valuation caps and conversion discounts on the cap table can assist you as you structure financing arrangements. Although valuation caps and conversion discounts can significantly improve returns to convertible shareholders, setting the conversion discount too high or the valuation cap too low can greatly diminish your ownership stake and weaken your ability to raise future financing. By consulting with trusted, knowledgeable advisers, and becoming fully aware of the possible consequences of convertible debt agreements, you can judiciously accept investments that will benefit your company in the long term.

Summary Table

Resources Consulted

- Cooley: Primer on Convertible Debt

- Cooley: The Convertible Note Cap

- Cooley: FAQ Convertible Debt

- Fred Wilson Blog: Convertible Debt

- Jason Mendelson Blog: Valuation Caps

- WSJ Blog: How Misunderstanding a Startup’s ‘Valuation Cap’ Can Get Expensive

- Tech Crunch: Convertible Note Seed Financing: Econ 101 for Founders

- Tech Crunch: Cap tables, share structures, valuations, oh my! A case study of early-stage funding

- Brad Feld Blog: How Convertible Debt Works

- Seed financing describes a startup’s early efforts to raise capital, often from friends, family, or angel investors.

- Typically led by VC investors, Series A funding rounds come after seed financing and usually represent a startup’s first substantive financing event.

- Most convertible debt agreements specify that future financing events must meet a minimum size requirement to prevent management from intentionally diluting seed investors.

- Pre-money valuation – The value that an investor agrees a company is worth before considering the value of her investment.

- A cap table displays the ownership structure of a company. For more information about cap tables, see our Dilution and Stock Pools article

- The number of fully-diluted shares refers to the number of shares outstanding after accounting for the effect of options, warrants and convertible debt.

- While ownership is a zero-sum game, a startup’s value is not. Sometimes surrendering equity can significantly enhance the value of the firm, if the new investor’s experience and network help the startup improve.